Business

What are Impulse Waves in Elliott Wave Theory?

Published

7 years agoon

By

Farhan Malik

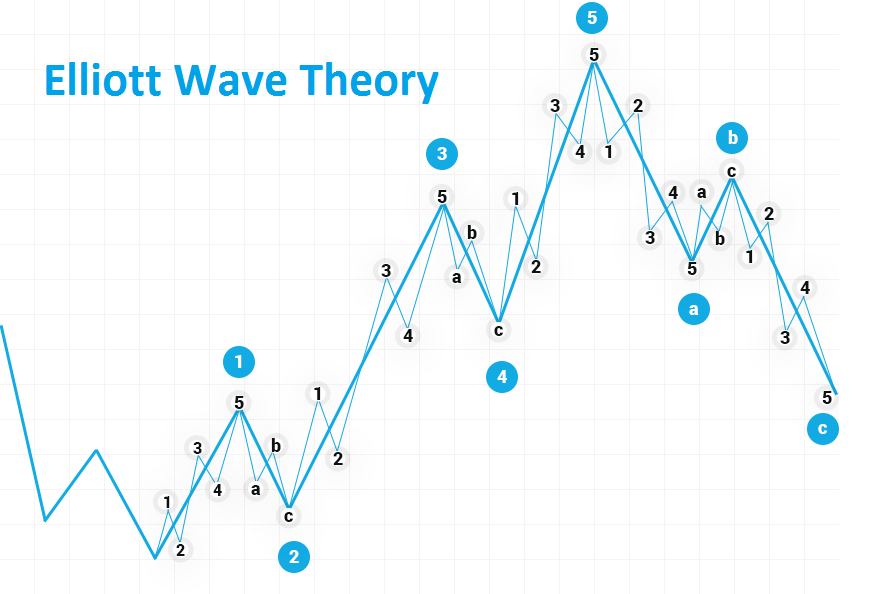

While many have perceived finance to be a complex integration, Ralph Nelson Elliot long figured that trade analysis presents itself in the form of waves. He coined this theory in 1930 and named it as the Elliott Wave Theory. It is still used till date by traders and stockbrokers to understand the temperament of the market.

Ralph was an accountant, in love with patterns. With numbers as his profession and logical patterns as his passion, he observed the repetition in the otherwise so-called unpredictable market. It is one of the most fascinating theories in existence which he categorized into:

- One corrective

- One Impulsive

This is the concept that he named after observing the constant flow of waves in the sea, big but following a pattern. He proposed that the market prices reveal themselves in particular patterns which can help predict the stock weather.

Some might consider to be laborious but once understood, practicing Elliott Wave Theory will simplify how you conduct your trade timing and analytical skills.

Here is the tact to apply this theory:

The Motive Waves

These are the first half of the Elliott Wave Pattern, marking the trend that is moving towards the ongoing trend and inclined towards the larger degree. It is divided as 1,2,3,4, and 5. Waves 1, 3 and 5 in the thought process wave are classified “actionary” sub-waves.

These are typically intention waves themselves, in that they move a similar way as the pattern of one bigger degree. Waves 2 and 4 are “remedial” sub-waves, moving the other way of the bigger pattern. The rationale wave will in general move without any difficulty toward the bigger pattern. Thusly, it is anything but difficult to spot and translate.

The Impulse Waves

The Impulse Wave is the sort of wave we have utilized so far to delineate how the structure of Elliott Wave is assembled. It is the most widely recognized thought process wave and the simplest to spot in a market. Like every rationale wave, five sub-waves: three thought process waves and two restorative waves. This is marked as a 5-3-5-3-5 structure.

Notwithstanding, it has three unbreakable guidelines that characterize its arrangement. In the event that one of these standards is damaged, at that point the structure isn’t a motivation wave and one would need to re-name the presumed drive wave.

The three principles are:

- Wave 2 can’t backtrack over 100% of Wave 1.

- Wave 3 can never be the briefest of waves 1, 3, and 5.

- Wave 4 can never cover Wave 1.

For a clear explanation, let us focus on the Impulse Waves and its categories.

Wave Extensions

In most cases, impulse waves will display what is called an “extension” to their typical example. This implies one of the motivation wave’s three thought process sub-waves will be a prolonged drive with overstated subdivisions. This can occur in either Wave 1, 3 or 5, ordinarily occurring in just one of said waves.

Now and again, the subdivisions of the all-inclusive sub-wave appear to be identical in abundancy and time span as the four different waves in the higher degree motivation wave of which they are a section. Rather than having a wave-check of 5 for the motivation, it is enticing to tally 9 waves, as it may not be clear regarding which wave is the all-inclusive wave.

Impulse Wave Truncation

There are times when the market has turned out to be so over-reached out in Wave 3 that there isn’t much power left for the motivation wave to go to an appropriate finish. At the point when this occurs, quite possibly the last influx of the motivation, Wave 5, won’t arrive at the part of the bargain before the market starts redressing the other way. Now, the market is simply excessively depleted. This condition is frequently called a “disappointment” or a “Truncation.”

A Truncation, or truncated fifth, comprises of 5 sub-waves, similar to every single rationale wave. It regularly happens after an especially solid third wave, despite the fact that there is additionally an opportunity that notion, out of the blue, has turned out to be so solid the other way of the pattern that a Wave 5 won’t end past the cost of Wave 3.

Diagonal Waves

The consummation corner to corner is a unique sort of wave that happens in Wave 5 of a drive, or the last influx of a remedy design – Wave C of an A, B, C amendment. This wave regularly happens when the previous move of the pattern has gone too far, excessively quick and has come up short on steam. In all cases, they are found toward the part of the bargain degree rationale or remedial wave. This wave example shows the end of the past pattern of one higher degree.

The wave-structure of closure askew is unique in relation to the motivation wave. Where the motivation wave had a general structure check of 5-3-5-3-5, the completion corner to corner has a structure tally of 3-3-3-3-3.

Leading Diagonals

Leading diagonals, which are very uncommon, are found in either the Wave 1 position of a motivation wave or in the Wave A place of a crisscross redress. They have a 5-3-5-3-5 wave structure like a motivation wave, be that as it may, for this situation, Wave 2 and Wave 4 cover and structure a wedge design with merging limit lines.

Wrapping Up

These Elliott Wave ideas may improve dealer’s investigation aptitudes or improve their exchange timing, yet it isn’t without its very own issues. The hypothesis can be unpredictable to apply, as it isn’t in every case simple disconnecting the five waves and three wave designs. The example additionally isn’t regularly present in individual stocks, yet rather applies to just vigorously exchanged resources which aren’t helpless to the purchasing or selling of just a couple of dealers.

The idea of drive and remedial waves is relevant to all business sectors and time periods, however, can in any case be utilized regardless of whether the hypothesis of the five waves and three wave value examples isn’t.

You may like

Sodziu: The Word With Many Meanings

CinndyMovies: A Simple Guide to Features, Safety, and Why People Talk About It

EchostreamHub: A Simple Guide to the All-in-One Streaming and Media Platform

What You Need to Know About Police Brutality?

12 Sites to Watch Free Online TV Shows with Complete Episodes in 2024