Business

Where do my taxes go?

Published

7 years agoon

By

Umer Abbasi

Are you wondering what happens to the money you pay for taxes? This article will help you understand some basics regarding where the money we pay in taxes goes. Get hold of us at Dean Roupas, and we will give you in-depth answers to all tax-related questions you might have.

- What are taxes?

Taxes are compulsory monetary contributions that every corporation or individual is expected to make to the governing entity. The term ‘contributions’ can be confusing in this case, so I guess I have to explain further. The government levies these contributions. This could be at the national, regional or local level. Factors including gross income and expenses are considered when determining the tax that an individual or corporate is expected to pay. Your tax advisor is in a suitable position to help you understand your tax bracket based on the earlier mentioned factors.

Now, let us dive into the deep stuff.

- What are taxes used for?

When we pay our taxes, they get into a large pool where everyone contributes to. The funds will be distributed to various sectors based on the policies and needs. I will explain further below. The primary purposes of taxes are resource allocation, income redistribution and economic stability. For the government to achieve these purposes, taxes are used in these and several other sectors.

- Social Security

Social Security is a federal benefits program established in 1935 in the United States. The program covers a range of benefits such as disability income, veterans’ pensions, and public housing. It is generally linked with retirement benefits that are paid every month until death. To be eligible for Social Security benefits, one needs to have earned at least 40 credits ($1 470/ credit) over ten years. The benefits one receives are calculated by averaging the wages from their 35 highest-earning years.

Payroll taxes primarily fund the Social Security system. Employers and employees pay 6.2 % in payroll taxes on the first $142,800 in annual income (in 2021). This amount goes towards social security. In 2018, the U.S. government spent $987.8 billion (23.4% of the total federal spending) on social security. In 2016, more than 60 million people in the United States received Social Security benefits.

- National Defence

Your taxes also contribute to the funding of national defence and security programs. Funds in this category support the Department of Defence and the expenses of international military programs. In 2018, America spent $631.2 billion (15% of the total spending) on the national defence.

“Current military” spending includes money set aside for the Department of Defense as well as the military element of other budget items. The other items include the maintenance of nuclear weapons by the department of energy. In 2020, this cost America $948 billion. “Past military” includes veterans’ benefits as well as a significant portion of the debt interest. The debts were primarily created by past wars and enormous military budgets. In 2020 America spent $696 billion on this.

- Medicare

Your taxes also support healthcare programs such as Medicaid, Medicare, Children’s Health Insurance Program and other public health initiatives. Medicare is a federal health insurance program for persons over the age of 65. It also covers people with disabilities, even if they are under the age of 65 and those with end-stage renal illness.

Medicare is divided into four sections in America: A, B, C, and D. Part A is automatic and covers medical treatments in medical facilities. Suppose you do not have additional healthcare coverage, such as through a job or a spouse. In that case, Part B is automatically activated. Medicare Advantage, or Part C, is a private-sector alternative to regular Medicare. Prescription drug coverage is covered through Part D.

These programs accounted for almost 28% of the federal budget last year (2020). In 2018, the government used $588.7 billion (14% of total spending) on Medicare.

- Education Programs

Your income taxes support Pell Grants, work-study programs, student aid, and elementary and secondary education efforts. Primary education is provided in public schools in the United States of America from kindergarten to the twelfth grade. This service is accessible free of charge to children and parents. The states have mandated this schooling, and property taxes and general federal taxes fund it. After completing this basic education, one is awarded a high school diploma, which serves as proof of essential skills to employers.

$95.5 billion, or 2.3 per cent of total spending, was spent on education, training, employment, and social services in 2018.

- Interest on the national debt.

The federal government ought to make regular interest payments on the money it borrowed to finance the past deficit. The national debt is $17 trillion, and the federal government borrows money and pays interest on it with your taxes. Interest payments accounted for almost 6% of the federal budget last year (2020). According to the 2019 federal budget, interest on the national debt totaled $375 billion, or nearly 8% of total expenditures. In 2018, $325 billion (7.7% of the total spending) was used to pay interest on the national debt.

All this money is taken from the taxes we pay.

- Food and agriculture benefits

Assistance programs such as the Supplemental Nutrition Assistance Program, the National School Lunch Program, and Federal Crop Insurance fall into this category. According to the 2018 budget, the U.S. government used $21.8 billion (0.5% of total spending) on agriculture.

These are some of the expenses that are catered for by the taxes you pay. Others include safety net programs, benefits for veterans and retired federal employees, transportation, science and medical research. Next time you file your taxes, keep in mind that taxes allow us to enjoy all the benefits that we do not directly pay for! Schedule a meeting with Dean Roupas so you can get further insight regarding what taxes are used for.

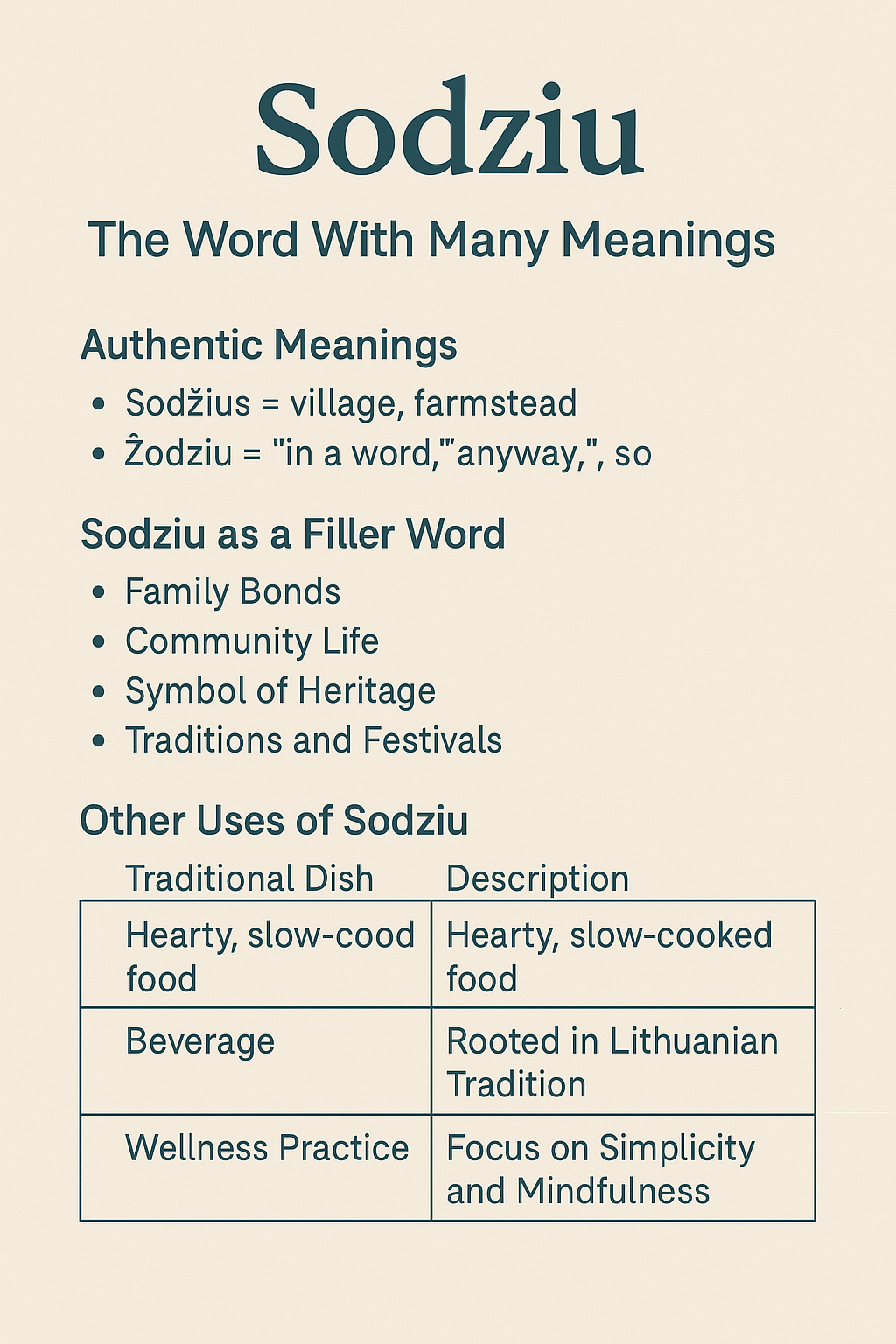

Sodziu: The Word With Many Meanings

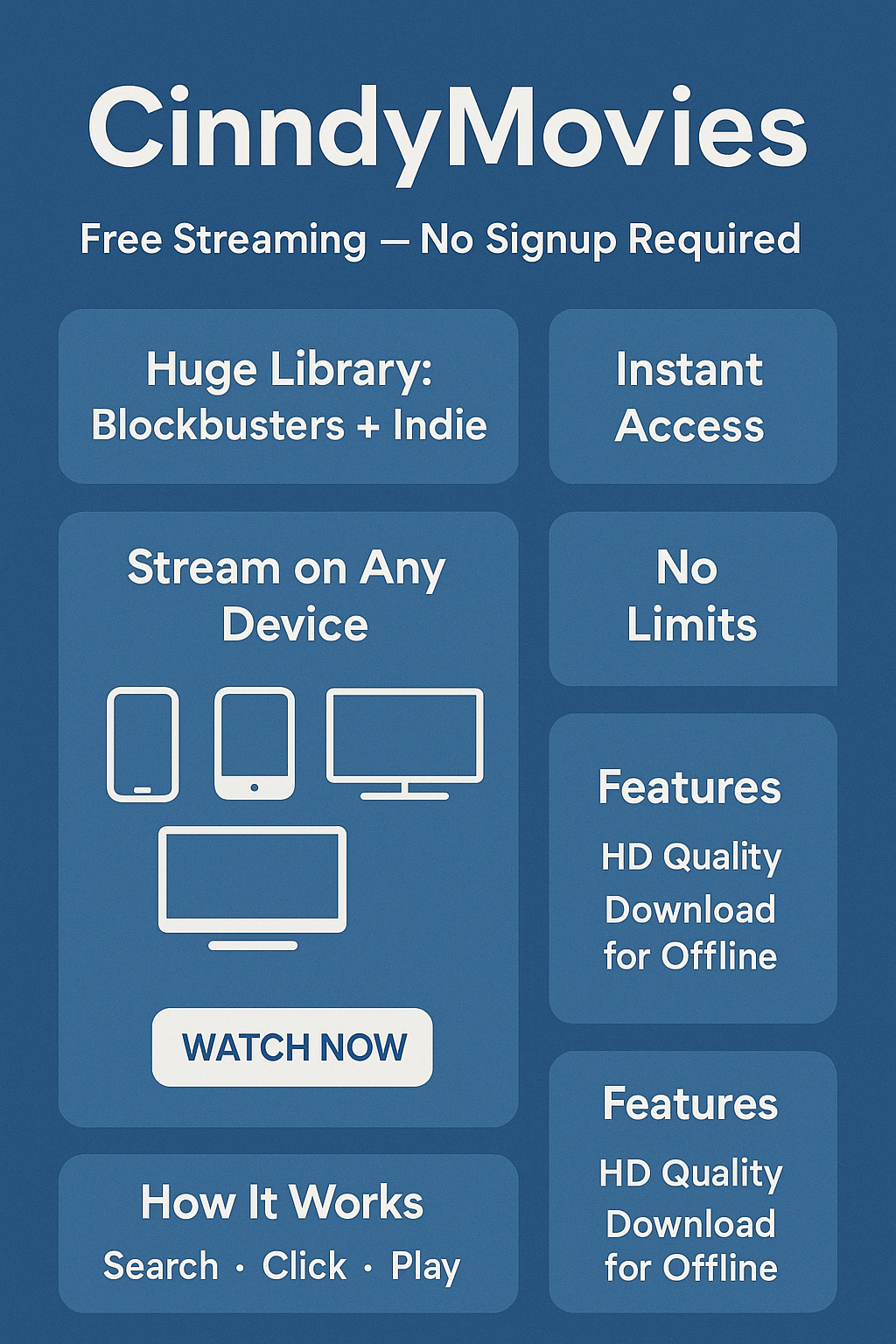

CinndyMovies: A Simple Guide to Features, Safety, and Why People Talk About It

EchostreamHub: A Simple Guide to the All-in-One Streaming and Media Platform

What You Need to Know About Police Brutality?

12 Sites to Watch Free Online TV Shows with Complete Episodes in 2024